All you need to know about Agentforce 3.0

Discover how Agentforce 3.0 brings enterprise-grade visibility, control, and integration to Salesforce AI agents—built for scale, not just experimentation.

Investment management entails more than merely purchasing and selling financial assets and other investments. Developing a short- or long-term strategy for acquiring and selling portfolio holdings is a management component. It might also include banking, budgeting, and tax-related services and obligations.

Providing investors with visibility is a significant challenge in investment management. It is fundamental to keep in touch with investors and give them access to reports and data when it is evident that face-to-face meetings will become increasingly far less common. Enhancing visibility between investors and owners boosts investor trust, reduces risk, and facilitates better communication between all parties.

Despite the volatile market environment caused by the pandemic in 2021, the investment management industry did well. While the overall trend is encouraging for 2022, there remain uncertainties around potential

COVID-19 variants. Regardless, the wealth management industry in India is at a pivotal moment. Nearly 80% of households are projected to have middle-class incomes by 2030, up from about 50% in 2019. This suggests that the affluent middle class is growing. The population of high-net-worth individuals (HNIs) in the nation is projected to increase from 3.5 lakhs in 2020 to 6.11 lakhs in 2025, a 75% increase. The proportion of ultra-high net-worth people is expected to grow by 63%.

So, this is an ideal opportunity to take a moment to reflect and recognize any potential missteps

“The coronavirus seems to have contributed significantly to a shift in how people think about investing. They are currently considering high-return investment options to have a cushioning sum that would sustain them in times of need or enable them to recuperate their lost funds.”

● The new generation of Millennial and Gen Z investors demands real-time interaction with financial advisors across channels. They need continuous access to investment options and portfolio information. Redesigning conventional investment ecosystems to suit this cohort’s expectations is essential.

● Wealth management will be hybrid in the future. Integrating digital and physical aspects: The basis of the wealth management sector has always been and will remain human relationships and partnerships.

● Alternative asset classes have emerged: in addition to passive investing, investing in unlisted businesses, private equity, investing in antiques and collectibles, and, most recently, non-fungible tokens (NFTs) and carbon credits, millennials are increasingly choosing non-traditional investment possibilities.

● Increasing regulatory vigilance: Regulatory bodies are paying greater attention to advisory companies’ fee structures, data security and privacy standards, adoption of AI and ML, use of cryptocurrencies, and ESG (environmental, social, and governance) funds.

The financialization of savings is accelerating. Traditionally, physical assets like gold and real estate accounted for most of the wealth. However, investors are now favouring financial savings over tangible ones. They are more conscious that an excessive concentration of wealth in non-financial assets might produce unfavourable returns in the face of rising inflation.

● Financial planning is becoming more comprehensive. The new generation of investors integrates financial goals with moral and personal objectives. They seek more all-encompassing investment options that incorporate social welfare, impact investing, estate planning, and retirement planning.

● The current trend calls for hyper-personalization. A one-size-fits-all strategy is no longer effective with investors. Every client touchpoint, whether investment goods, marketing communications, or call centre operations, needs to be personalized to increase customer loyalty and trust. They prefer meticulously chosen, precisely tailored, and contextually relevant offerings.

Effective wealth management requires a thorough, detailed understanding of the customer. But as we can see from the above-mentioned trends, consumers are evolving. And it can be challenging to keep track of their monetary requirements, habits, aspirations, investment portfolios, transactions, and life events, mainly when all this information is dispersed over documents, various platforms, and spreadsheets.

Well, if you had a single source that offered easy access to customer data, how much faster would it be to interact with customers, confidently respond to their inquiries, and guide them towards the best investment options?

Let us know your thoughts!

For more blogs: https://areya.tech/blogs/

To know more: connect with us today!

Contact: [email protected]

Trusted Technology Partner

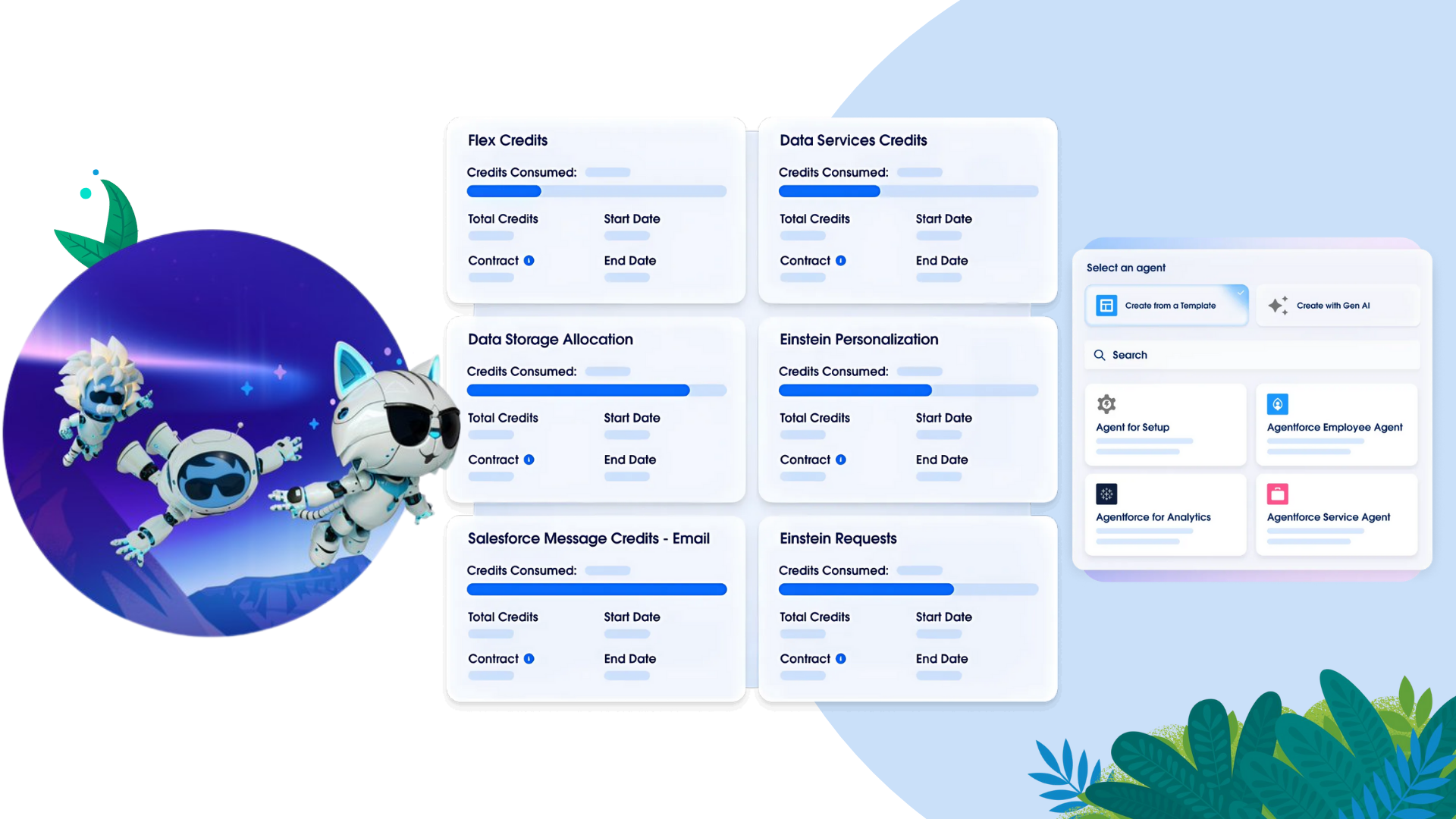

Discover how Agentforce 3.0 brings enterprise-grade visibility, control, and integration to Salesforce AI agents—built for scale, not just experimentation.

Explore Flexible Agentforce Pricing that scales with your AI goals — and see how Areya helps implement smart, cost-effective digital labor solutions.

Discover how Pixelstreamer Studios used Agentforce to transform media sales with AI-driven insights, smart RFPs, and real-time account intelligence.

Discover Agentforce 2dx—Salesforce’s smartest automation yet. Dynamic reasoning, richer experiences, and real-world impact across every workflow.

One Bay Plaza, 1350 Old Bayshore Hwy,#520 Burlingame, CA 94010

IndiQube Edge 4th floor Bellandur, Bengaluru, Karnataka 560103

OYO Workspaces India Pvt. Ltd. Above Vijay Sales, 2nd floor, Pride Purple Accord, Baner road, Baner, Pune - 411045

Get a Free Health Check – Identify areas for improvement and optimize your Salesforce instance with Areya.